Are You Overwhelmed by Your Accounting Woes?

If you’re a small business owner, chances are you’re wearing many hats, including that of an accountant. But don’t despair! There’s help available in the form of accounting software designed specifically for small businesses. These user-friendly programs can make your life easier and help you stay on top of your finances.

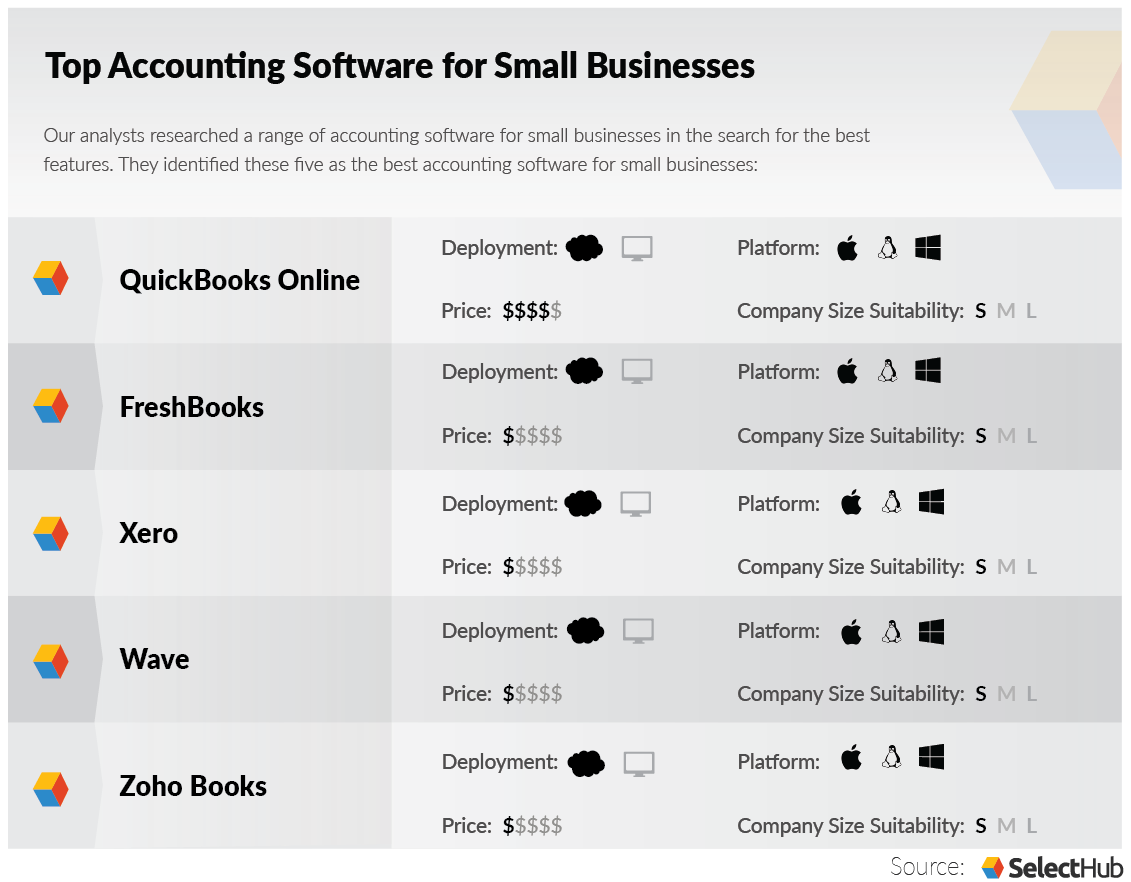

We’ve done the legwork for you and rounded up the best accounting software options for small businesses.

Features to Consider

When choosing accounting software, it’s important to consider the features that are most important to your business. Some of the must-haves include:

Additional Tips for Choosing the Right Software

In addition to the features listed above, here are a few other things to keep in mind when choosing accounting software:

Our Top Pick

If you’re looking for a comprehensive and affordable accounting software solution, we highly recommend QuickBooks Online. This cloud-based software offers a wide range of features, including invoicing, expense tracking, financial reporting, and payroll processing. It’s also easy to use and affordable, making it a great choice for small businesses.

Best Accounting Software for Small Business

Selecting the right accounting software is crucial for small businesses looking to streamline their financial management. QuickBooks Online stands out as a top choice, offering a comprehensive suite of tools tailored to meet the needs of small business owners. Its user-friendly interface, automated features, and mobile accessibility make it a practical choice for businesses on the go.

Cloud-Based vs. Desktop

Choosing between cloud-based and desktop software depends on your business’s specific requirements. Cloud-based software, like QuickBooks Online, is hosted on remote servers, allowing access from any device with an internet connection. Desktop software, on the other hand, is installed locally on a computer and does not require an internet connection for use.

Advantages of Cloud-Based Software

Cloud-based software offers several advantages. Its accessibility from any device, including smartphones and tablets, makes it convenient for businesses with remote employees or frequent travel. Automatic updates ensure you’re always using the latest version, eliminating the need for manual updates. Data security is also enhanced as it’s stored on remote servers with robust security measures.

Disadvantages of Cloud-Based Software

However, cloud-based software also has drawbacks. The reliance on an internet connection can pose challenges in areas with poor or unstable connectivity. Additionally, subscription fees can accumulate over time, unlike desktop software, which requires a one-time purchase.

Advantages of Desktop Software

Desktop software offers advantages too. Its offline accessibility makes it suitable for businesses operating in areas with unreliable internet access. One-time purchase eliminates ongoing subscription fees, providing cost savings in the long run.

Disadvantages of Desktop Software

The downside of desktop software lies in its limited accessibility. It can only be used on the computer where it’s installed, making remote access difficult. There’s also the risk of data loss due to hardware failure or malware attacks.

Best Accounting Software for Small Business: A Comprehensive Guide

As a small business owner, you’re constantly juggling multiple responsibilities, and managing your finances can often feel overwhelming. That’s where accounting software comes in – it’s akin to having a trusty sidekick that streamlines your accounting tasks, saving you time and keeping your finances organized. We’ve scoured the market to uncover the best accounting software options tailor-made for small businesses, so you can make an informed decision and let your accounting woes become a thing of the past.

Best Accounting Software Options

From managing invoices to tracking expenses, the right accounting software can make a world of difference for your small business. Let’s dive into some of the most popular options available:

**QuickBooks**: An industry giant, QuickBooks boasts a comprehensive suite of features, including invoicing, expense tracking, inventory management, and payroll processing. Its user-friendly interface makes it a popular choice for small businesses looking for a reliable and feature-rich solution.

**Xero**: Known for its cloud-based functionality, Xero offers a seamless accounting experience from anywhere, anytime. Its intuitive dashboard provides real-time insights into your financial performance, making it a great option for businesses that value flexibility and accessibility.

**FreshBooks**: Simplicity is at the heart of FreshBooks. Designed specifically for small businesses and freelancers, it simplifies accounting tasks with its user-friendly interface and automated features. Its focus on invoicing and expense tracking makes it a time-saving solution.

**Wave**: For those looking for a budget-friendly option, Wave is a cloud-based accounting software that offers essential features for free, including invoicing, receipt scanning, and expense tracking. Its paid plans provide additional functionality, making it a scalable solution as your business grows.

**Zoho Books**: Aiming to provide a holistic financial management solution, Zoho Books integrates seamlessly with other Zoho applications, such as CRM and inventory management. Its comprehensive feature set, including project tracking and time billing, makes it a great fit for businesses that need a comprehensive accounting suite.

Things to Consider When Choosing Small Business Accounting Software

When selecting accounting software, it’s not a one-size-fits-all approach. Consider the following factors to make the best choice for your business:

**Industry-Specific Features:** Does the software cater specifically to your industry’s unique accounting needs?

**Scalability:** Can the software grow with your business, accommodating increasing transaction volumes and additional users?

**Integration:** Can the software seamlessly connect with other business applications you use, such as CRM or e-commerce platforms?

**Pricing:** Does the software’s pricing model align with your budget and the value it provides?

**Customer Support:** Does the software provider offer reliable and responsive customer support when you need assistance?

Implementation and Training

Once you’ve chosen your accounting software, the implementation process is crucial. Follow these steps:

**Data Migration:** Transfer your existing financial data accurately and efficiently.

**Configuration:** Tailor the software to your specific business needs.

**Training:** Ensure your team is well-versed in using the software effectively.

Conclusion

Choosing the right accounting software for your small business is a key decision that can streamline your financial management and save you valuable time. By considering the factors discussed in this article, you can make an informed choice that will empower your business to thrive. Remember, accounting software is not just a tool but an investment in the financial well-being of your enterprise.

Best Accounting Software for Small Businesses

In the fierce battlefield of small business, where every penny counts, finding the ideal accounting software is like discovering the Holy Grail. It can transform your financial management, freeing up precious time and empowering you with data-driven insights. Our comprehensive guide will lead you through the maze of options, highlighting the best accounting software that will elevate your business to new heights.

Unveiling the Top Contenders

The market abounds with accounting software solutions, each promising to be the silver bullet. However, our rigorous research has shortlisted the crème de la crème:

Features to Prioritize

When choosing accounting software, consider your business’s specific needs. Here are some key features to look for:

Essential Integrations

Maximize your accounting software’s potential by integrating it with other business tools. Consider:

Exceptional Customer Support

When you encounter challenges, you need a reliable support team to back you up. Look for accounting software providers that offer:

Pricing Considerations

Accounting software can range from free to thousands of dollars per month. Determine your budget and consider the features and support you require. Most providers offer tiered pricing plans to cater to different business sizes and needs.

Free or Freemium Options

If you’re on a shoestring budget, free or freemium accounting software can be a good place to start. However, be aware of limited features and potential data storage restrictions.

Paid Software

Paid accounting software typically offers more robust features, enhanced support, and unlimited data storage. Pricing varies based on the number of users, features, and the level of support required.

Conclusion

Investing in the right accounting software can streamline your financial management, save you time, and provide valuable insights into your business’s performance. Consider your business’s unique needs, prioritize essential features and integrations, evaluate pricing options, and seek exceptional customer support. With the right software on your side, you’ll unlock the power of data-driven decision-making and propel your business towards success.

Leave a Reply